- Image via Wikipedia

In a recent discussion among traders, the idea of how to measure the correlation between various ETFs in the world market model arose.

Here is my method:

I set up a table, updated automatically daily iwant to compare the daily % gains and losses as the data points, then just pick the desired time frames and run =CORREL on it in Excel, that uses the =CORREL function to find the correllations between the broad indices

Iwant to compare the daily % gains and losses as the data points, then just pick your desired time frames and run =CORREL on it

I use XLQ from qmatix.com to fetch and update daily performance data; a great time saving utility program with a robust set of functions and a great yahoo group.

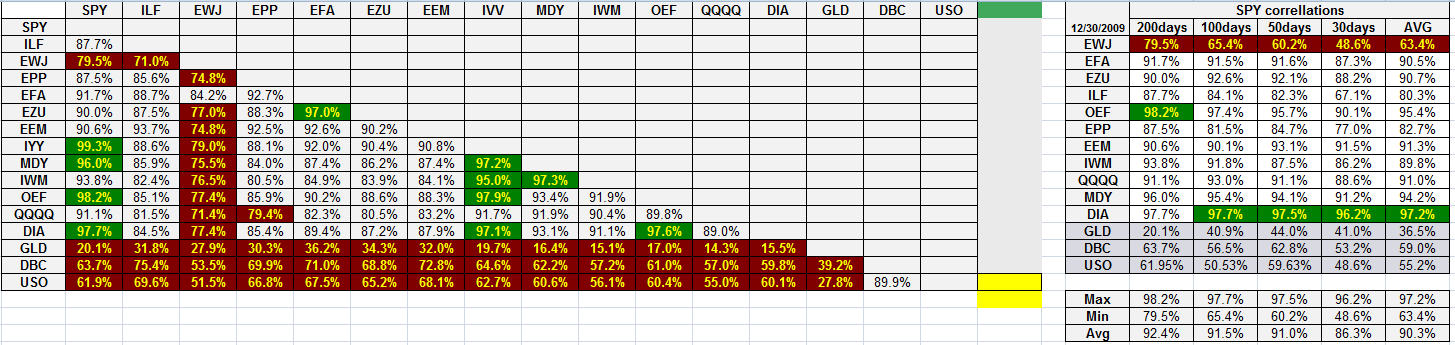

see attached snapshot of todays correllations

the left table is a cross-correllation on 200 days of data

the right table is 4 diff times frames of indices vs SPY

green is exceptionally highly correllated, red is exceptionally uncorrellated for that data set

Related articles by Zemanta

- A reflection on leading and managing a complex Participatory Action Research curriculum project (kansasreflections.wordpress.com)

- A deceptively simple management “game” for appreciating Force Management (usacac.army.mil)

- The Benefits of Equity Commodity ETFs (seekingalpha.com)

- Correlation Between Stocks and Gold: An Explanation (blogs.wsj.com)

- The Shifting Currency-Equity Market Relationship (seekingalpha.com)

- Market Surprise: Stock Market Decouples from Dollar (seekingalpha.com)

- In Search of the Conditionally Correlated Hedge: VXX vs. VXZ (seekingalpha.com)

- ETFs for 2010 (seekingalpha.com)

- Diversification, Schmversification: All Correlations to 1.0(-ish) (paul.kedrosky.com)

- Three Commodity ETFs in ‘Anti-Contango’ (seekingalpha.com)

- Global Equity Markets: So Much for Diversification (seekingalpha.com)

- The U.S. Dollar and Asset Price Correlation (seekingalpha.com)

- culture and climate (kansasreflections.wordpress.com)

- A thought experiment for revolutionary leadership (usacac.army.mil)

- Army Enterprise Task Force: potentially greatest in-house management re-organization ever (usacac.army.mil)

- Reflecting on scenario support to CGSC, TRADOC and the Army (usacac.army.mil)

- A reflection on Hunt’s “Leadership: A new synthesis” (1996) (kansasreflections.wordpress.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=420b60da-c5cb-4a22-8918-9e75f27d37ed)