Upgrade from Intensive Care to Critical

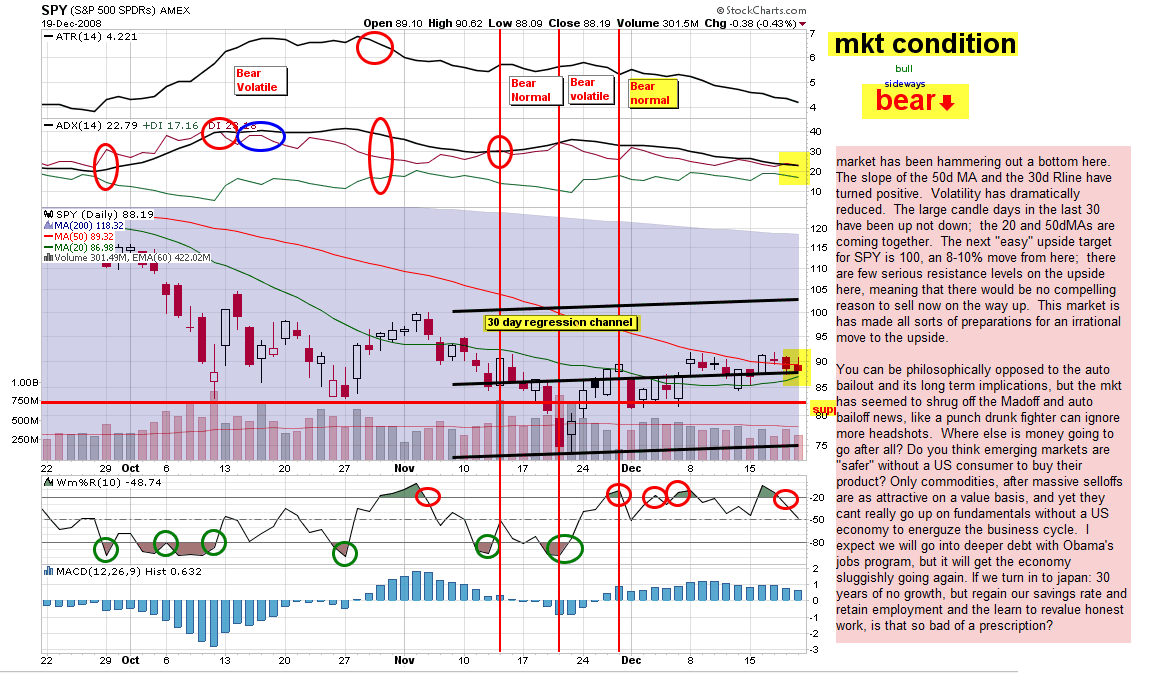

market has been hammering out a bottom here. The slope of the 50d MA and the 30d Rline have turned positive. Volatility has dramatically reduced. The large candle days in the last 30 have been up not down; the 20 and 50dMAs are coming together. The next “easy” upside target for SPY is 100, an 8-10% move from here; there are few serious resistance levels on the upside here, meaning that there would be no compelling reason to sell now on the way up. This market has made all sorts of preparations for an irrational move to the upside.

You can be philosophically opposed to the auto bailout and its long term implications, but the mkt has seemed to shrug off the Madoff and auto bailoff news, like a punch drunk fighter can ignore more headshots. Where else is money going to go after all? Do you think emerging markets are “safer” without a US consumer to buy their product? Only commodities, after massive selloffs are as attractive on a value basis, and yet they cant really go up on fundamentals without a US economy to energuze the business cycle. I expect we will go into deeper debt with Obama’s jobs program, but it will get the economy sluggishly going again. If we turn into japan: 30 years of no growth, but regain our savings rate and retain employment and the learn to revalue honest work, is that so bad of a prescription?