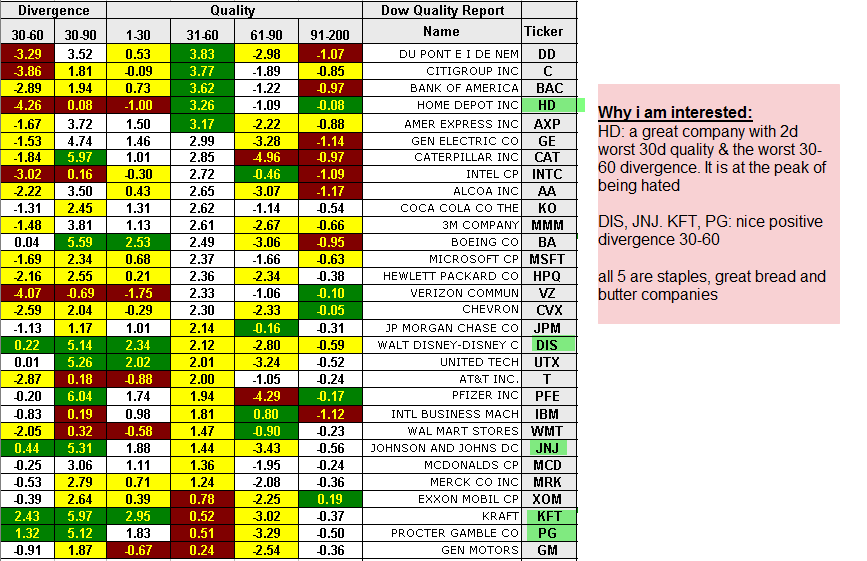

a subtle way to find stocks beginning to quietly outperform their peers within the Dow30 industrials.

Using a formula for computing quality that considers both the gains and the relative volatility over various time periods allows us to examine relative performance improvements in a way that cannot be duplicated with reading individual charts

the first chart examines how to frame a favorable reward:risk ratio trade in PG (Proctor & Gamble) for a short term tradeis a performance table, and the second chart shows the analysis table that identified PG as a favorable candidate.