Alice: “Would you tell me please, which way I ought to go from here?” The Cheshire Cat: “ That depends a good deal on where you want to go”

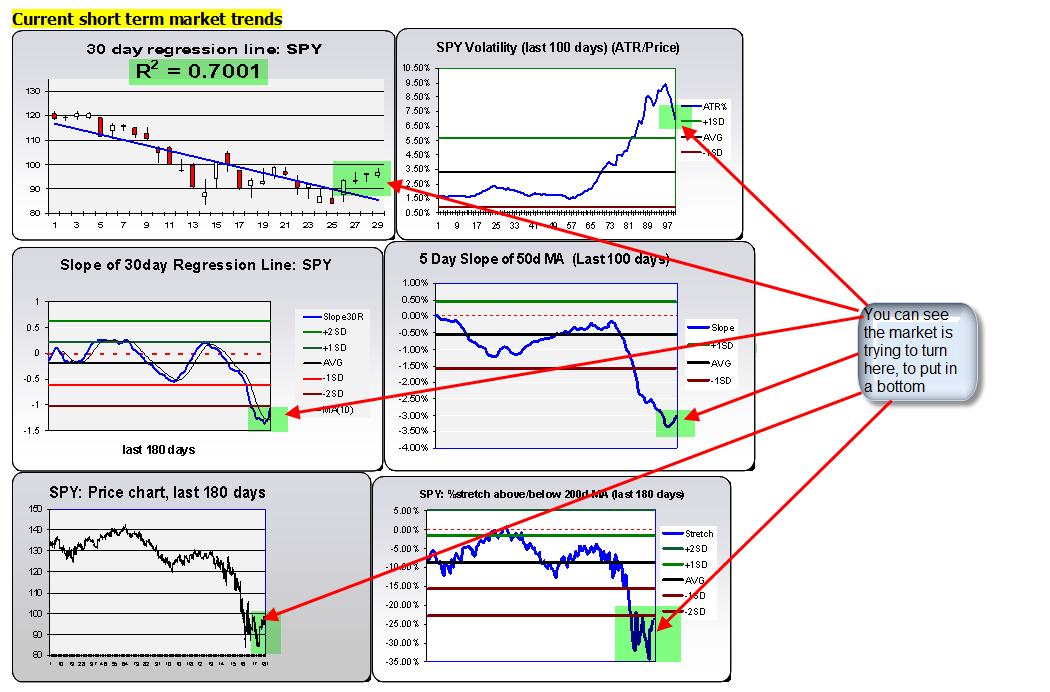

1. I’d like you to take a look at the “Market Health Check” chart below to take a look at the annotations this week concerning a potential turning point in market conditions. There is about equally convincing evidence that the market is putting in a bottom here or has just put in a “dead cat bounce”. Your interpretation probably is a function of a deeper “gut” belief in what the market should do. I don’t have an opinion about market direction here, but I am prepared to go in the direction of the trade, by identifying probable targets to the upside if the market goes up, and probable targets if the market goes down.

2. At the simplest level, for illustration only with the S&P 500 sector SPDRs in the table below, the 2 strongest sectors of the 9 are energy and consumer staples, while the weakest are materials and financials. If I see the market failing in front of my eyes AND the materials and financials are failing faster than SPY, I will have enough evidence to short those 2 immediately since it is a resumption of the previous weak trend. If on Monday the market is going up AND energy and Consumer staples are going up faster than SPY, then I have enough information to go long those 2 immediately because the recent leaders are continuing to lead.

3. The point of this discussion is to say that it is not always necessary to have an opinion and a prediction about direction, which then I become emotionally attached to. Sometimes maybe I can just let the market show me the way.